NEWARK, NJ — When it comes to raising capital for a new business, women of color often find themselves trying to kick water uphill, according to Elizabeth Clayborne.

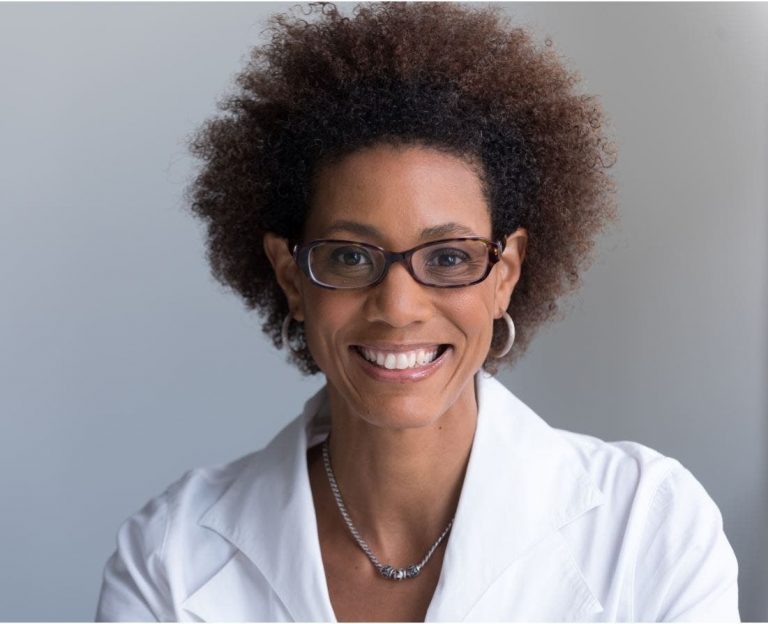

“White men only have to go through seven people to get to a yes – Black women must go through 70 to get to a yes,” contends Clayborne, an emergency room physician who is the entrepreneur behind NasaClip, a nosebleed treatment device that has been featured on national news media reports.

Clayborne was one of several female business leaders who gathered for the fifth annual Women of Color Connecting Summit, held earlier this month. The virtual event was spearheaded by Newark-based nonprofit Institute For Entrepreneurial Leadership (IFEL) in an effort to brainstorm ways for women of color to grow and scale their businesses.

Find out what’s happening in Newarkfor free with the latest updates from Patch.

According to Jill Johnson, the nonprofit’s CEO, “capital constraint” remains a defining problem for women of color in the business world.

Johnson said that despite a five-year high in venture capital funding, women of color entrepreneurs continue to receive just a “fraction” of venture capital funding. Read More: Education Can’t Trump Lack Of Capital For Black Business, NJ Advocate Says

Find out what’s happening in Newarkfor free with the latest updates from Patch.

The three-day summit brought together more than 700 attendees, who shared the challenges they’ve faced trying to get their businesses up and running – and advice on how to overcome them.

According to the IFEL, some key themes which emerged from the summit included the necessity for more effective accountability measures within DEI programs; the importance of acting on good intentions; the elimination of misconceptions and myths surrounding the investment risk in women of color-owned companies; the lack of diversity within the investor ecosystem and at VC firms; and the need for collaboration, transparency and honest communication between allies and champions, investors, philanthropists and government.

Here are just a few of the “pearls of wisdom” that emerged from the summit, the IFEL said.

ANTIQUATED VIEWS AND BIAS

Robin Wilson of Clean Design Home Inc. and Emelyn Stuart of Stuart Cinema & Cafe said they have experienced the same roadblocks to capital access.

“There are so many biases I don’t know where to start,” Stuart said. “I’m building my movie theaters from scratch and dealing with people who are not used to working with women leaders, and that, I believe, affects funding and how money is allocated.”

According to Stuart, she could not procure money from her bank because she had no debt and actually built the business using her own money. After consistently showing profit, she was still denied and believes that funders need to look through a wider lens.

“Being the first one to do something is hard, but I don’t want to be the last woman to do something like build a theater,” Stuart said. “It’s not just about helping me – it’s about all the people in my community.”

Robin Wilson of Clean Design Home, Inc. echoed those sentiments, and said she has never been funded despite a 22-year record of profit.

“I remember going to a funding meeting and being told that we have never seen a brand like you,” Wilson recalled. “There is diminishment. When you stick to it for so long, there is this attitude that since you’ve been doing this for so long, there must be something wrong with your business because nobody has ever invested.”

“That stick-to-itness should be rewarded and viewed as positive, not negative,” Wilson said.

MINDSETS OF SCARCITY

Amber Gilbert and Janelle Benjamin left the corporate world to pursue their passions, an experience they shared at the summit. While Gilbert stayed on with the buying company and is still there today, both women stood strong on what is needed to help women of color move forward faster.

For Gilbert, the scarcity mindset she observed in other women of color is unnerving.

“I ran into mindsets of scarcity as opposed to abundance,” Gilbert said. “Having that mindset of scarcity prevents the ecosystem from opening up and prevents success.

“We must come at this problem from a sense of abundance,” she added.

Benjamin, who has been an investor ever since her exit in 2018, wants to see women of color think bigger, and like Gilbert, has witnessed a ‘this is all I can get’ mentality.

“We need to push women of color a little more to think bigger and go a little further,” Benjamin urged. “Someone offered me a million dollars, and I was like, wow! I called my advisor all excited, and he said, ‘What are you crazy … don’t even call that person back.’ So think bigger as opposed to thinking, ‘This is all I will get.’”

SYSTEMIC BARRIERS

In a presentation titled “Unpacking Capital Access,” JoAnn Price, co-founder and managing partner of Fairview Capital, and Chanel Cathey, founder and CEO of CJC Insights, LLC, explored systemic barriers within the investor ecosystem. They also provided perspective into “why diversity among capital allocators is a key component of equity and inclusion within the entrepreneurial ecosystem.”

“The risk isn’t really the point,” said Price. “Fairview says no a lot, but our doors are always open to everyone for honest conversation and discussion.”

According to Price, the barriers have to do with lack of individuals at companies who do not focus on diversity, equity and inclusion.

“What’s really important is that the capital paradigm is beginning to grow. We as women cannot sit back and wait for someone else to provide an opportunity,” Price said. “The only way to change it is to step in and make a difference.”

DIVERSITY THEATER

According to the IFEL, Barbara Clarke, founder of The Impact Seat Foundation, was an early investor in women and Black-owned companies. While she was able to identify companies to invest in, she noticed that industry chatter about inclusive investing was not accompanied by action.

“Diversity theater … there was a lot of that,” Clarke said. “People were talking about doing something, but nobody did anything. There were groups trying to invest and saying they wanted to invest, but they didn’t change any of their processes.”

Clarke said that people, especially allocators, need to question their processes and ask if they are looking at all companies equally. Leveraging the power of personal and professional networks to help under-represented founders is especially important, she said.

“Never underestimate social capital and time in angel investing,” Clarke insisted. “It’s really important for folks to use their social capital, especially when dealing with an under-represented founder. You can’t just do a hand off or simple introduction. You must be there with them. Be there in the room with them. Vouch for them as an ally.”

RELATIONSHIP BUILDING

According to the IFEL, the story of Adrienne Fudge, founder of 40 Dreams Catering, and chef David Martone, founder of Classic Thyme Cooking School, demonstrates the valuable power of “relationship-building.”

Here’s why, the nonprofit said:

“Fudge, a former communications professional with a passion for cooking, experienced a great deal of growth in her business and needed to find a bigger location. Chef David Martone, founder of Classic Thyme Cooking School, had a building to sell. After COVID-19 destroyed his sense of taste and smell, Chef Martone decided to close the business and sell the building housing his business. Fudge, in search of a building but worried about financing, called about Martone’s building. She was not particularly optimistic as in the past, people seemed to not want to sell to her. All of this changed in an instant when Martone invited Fudge to dinner.”

According to the IFEL, Fudge’s business advisor cautioned her that this was not the way to do business.

“But it is how to do business,” Martone told attendees at the summit. “My father taught me that when you want to do business with someone, you sit down and have dinner first. I thought to myself how great it would be to have a business like Adrienne’s in my community. Look at all she has accomplished.”

Fudge continued to worry about financing and the unfavorable terms from her bank attaching her personal assets. Martone urged Fudge to contact him with any issues. She postponed talking to him.

But a twist to the story shows the importance of taking action on good intentions, the IFEL said. While Fudge never even had to ask Martone for financing, he offered to hold the mortgage note.

“It’s all so perfect,” Fudge said. “This was different from just being validated. It was more like acceptance, open and complete acceptance. You don’t find this very often.”

Martone made it clear that this was not charity or philanthropy and spoke about the time that he received help from the previous owner of the building when he was the buyer.

“There was nothing to make this deal not happen,” Martone said. “Adrienne had everything. She came to the table to do business. She was prepared. I wanted to see it happen. When I was trying to buy the building, I took an equity loan to do renovation and then needed to get funding. The owner helped me, so why would I not do this for someone else? It made all the sense in the world.”

Send local news tips and correction requests to eric.kiefer@patch.com. Learn more about advertising on Patch here. Find out how to post announcements or events to your local Patch site. Don’t forget to visit the Patch Newark Facebook page.

Get more local news delivered straight to your inbox. Sign up for free Patch newsletters and alerts.